The cost of making web banking safer strategies losing a slight bit of the “wherever, any time” convenience that makes it so uncommon.

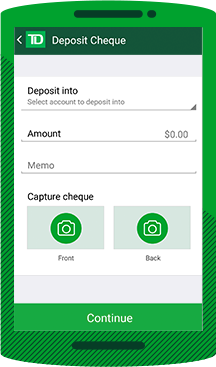

You can see this trade-off in the reaction to a security cycle considered two-adventure affirmation that Toronto-Dominion Bank has been showing up for the ongoing months.td canada trust login easyweb is by and by offering clients the decision to relegate in any event one of their electronic contraptions – PC, work station, tablet or phone – as a trusted in a device that won’t need additional affirmation when they sign in to a bank or adventure account.

For various devices, conceivably a just-purchased PC, one used at work, or one of each a motel’s business network, you’ll need a phenomenal access code to complete the login cycle. This code is delivered to you on your mobile phone by text, or you can call TD to get your record opened.

Two-adventure affirmation (to a great extent implied as two-factor approval) replaces the security tends to that are regularly used to ensure the person who marked into a record online is a customer. Organization wellbeing masters think these requests are a feeble strategy to make sure about client insurance – they’re consistently guessable if a developer has even a little information about you.

Online lender BMO InvestorLine and Robo-counsel WealthSimple are among the budgetary establishments that have grasped two-adventure affirmation. A few banks use a variety of such security when clients need to complete certain trades on the web, say changing individual contact data. Be that as it may, TD’s move may be the most freeing introduction from two-adventure check-in online banking up until this point. A couple of the bank’s clients have contacted me authentically to whimper, and various others have been discussing the preferences and impediments on my Facebook singular record page.

A TD agent portrayed two-adventure confirmation as being more secure and offering more protection for customers.

If you’re one of those people who are never without their phone, two-adventure affirmation is a non-issue. In any case, envision a situation where you’re not part of the wireless age.

TD perceives that development has been clients’ most prominent issue related to two-adventure approval. In case you have to use a contraption that isn’t known to the bank, you’ll either need to sort out some maybe cause wandering costs. Note: It’s not a decent idea to sign in to your financial records from a PC in a hotel because of the peril it’s defiled with spyware that gets your information.

We hear progressively more about data breaks at banks and various associations, anyway, they regularly incorporate the foundation itself. We saw that in May when Bank of Montreal and online bank Simplii Financial advised that fraudsters may have gotten to singular data for a merged 90,000 or so clients.

Nonetheless, hooligans in like manner follow data at an individual level as well. That is the story behind the malware (pernicious programming) and phishing messages expected to direct your PC or your information.

Convenience is the expense to be paid while improving the security of web banking. The alternative is to be all the more helpless against a criminal segment that is constantly looking at for deficiency in online security. You should be more worried over a bank that isn’t using two-adventure confirmation than one that is.