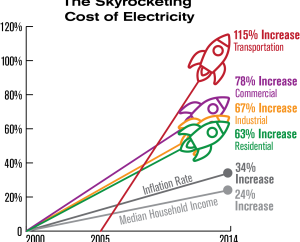

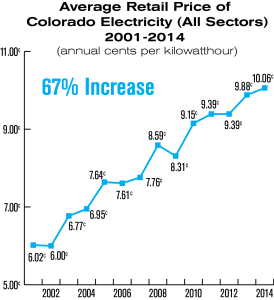

The world economy was heavily dependent on electricity and the structure of the market was increased complexly to consider energy and rates towards the electricity rates format. For example, Hamlin Energy Plans are the best energy rates that satisfied all kinds of criteria. These rates are well characterized with the help of a non-linear relationship to fundamental variables and its relationship is also very challenging to all models. Bunn introduces quantile regression for electric rates. It marks the values of the quantile model for value at risk forecasting that compares to the caviar and garch method. This was a methodological comparison and doesn’t address deeply inter-day characteristic minutes by minutes in the price rush distribution. All peoples know that rate formats differ systematically each day with several models generally specified in off-peak, mid-peak, and peak hours that reflect various technologies setting the rate value and dynamic load. From this one question that will arise in everyone’s mind was how it determines the risk varies on indray basis. It also contains various stands of literature by using quantile regression to forecast electricity rates represented by Weron and Maciejowska etc. But this approach differed from Bunn’s.

Let the light shine in

He uses quantile regression to combine various point forecasting methods and distribute over each point forecast, by creating a sort of ensemble model. It will produce accurate rates forecast and more robust, but it was not designed to show accurate price distribution. In the energy market, there are several agents like regulators, traders, consumers, and suppliers, detailing the price distribution is very important when compared to formulating Central expectations. Weakness of data in trials and high sensitivity of the result leads to misspecification in the functional form of modeling and distribution will be difficult. From robust parametric method specifies a switching model, predictive functions, and also semi-parametric formulation for specific quantiles, it has characterized recent research also. Koenker and Basset introduce linear quantile regression but later explained it by Naiman and Hao and also other researchers. It drives the semi-parametric formulation of predictive distribution so that quantiles can be used with individual regressions. It will very useful to find several coefficient values for fundamental factors at different levels. Generally, electricity rates have various sensitivities to fundamental variables across the price distribution, it is due to non-linear properties, this quantile regression is best suited for modeling the electricity rates. Various models were created to capture various price format processes for extreme and normal events. Bunn and karakatsani used Markov regime-switching model at the same time Bunn used the smooth transition regression model. Modeling the quantiles directly with the quantile regression without any assumption about residual distribution. Electricity rates are characterized by volatility clustering, skewness, high spikes, and high volatility. It was non-normal behavior for electricity rates that makes semi-parametric techniques like quantile regression. We can also go through the relationship between independent and dependent variables across the whole distribution, and it builds up a complete picture of how the electricity rates are affected by fundamental factors in different price ranges. Quantile regression was related to the value of risk in calculating the price at extreme quantiles. In the point of rush perspective we want to calculate the tail dependencies accurately and also quantile regression has to work well for this purpose.